The Prime Minister has declared UK inflation is “back to normal” in a “major milestone” for the country, as it hit its lowest level in nearly three years despite falling by less than economists were expecting.

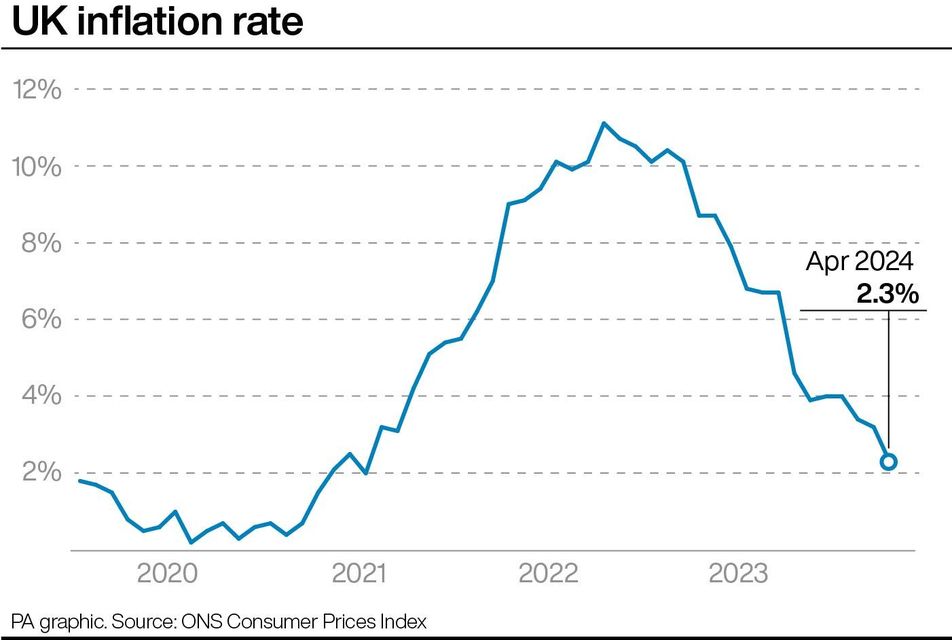

Consumer Prices Index (CPI) inflation slowed to 2.3% in April, down from 3.2% in March, according to the Office for National Statistics (ONS).

It is the lowest level since July 2021 when inflation was recorded at 2% – the Bank of England’s target level.

But the decline was smaller than expected as economists had predicted CPI would fall to 2.1% in April, within a whisker of the Bank’s target.

Some experts said this could come as a blow to chances that the Bank’s policymakers will feel confident to cut interest rates next month.

The latest data means prices are still rising across the country, but at a much slower rate than in recent years when households and businesses were being squeezed during the peak of the cost-of-living crisis.

Speaking in Downing Street, Rishi Sunak said the fall in inflation is a “major milestone”, but he admitted there is “more work to do”.

The Prime Minister said: “Thanks to everyone’s hard work and resilience, today we have reached a major milestone and inflation is back to normal.

“That is an important moment for our country, for the economy, and shows that our plan is working.

“Whilst I know people are only just starting to feel the benefits and there is more work to do, I hope this gives people confidence that if we stick to the plan there are brighter days ahead.”

He added that “these things don’t happen by accident”.

Nevertheless, the ONS said a big drop in energy prices was the main reason why inflation was lower last month.

Gas and electricity prices plunged by more than a quarter in the year to April, the largest fall on record.

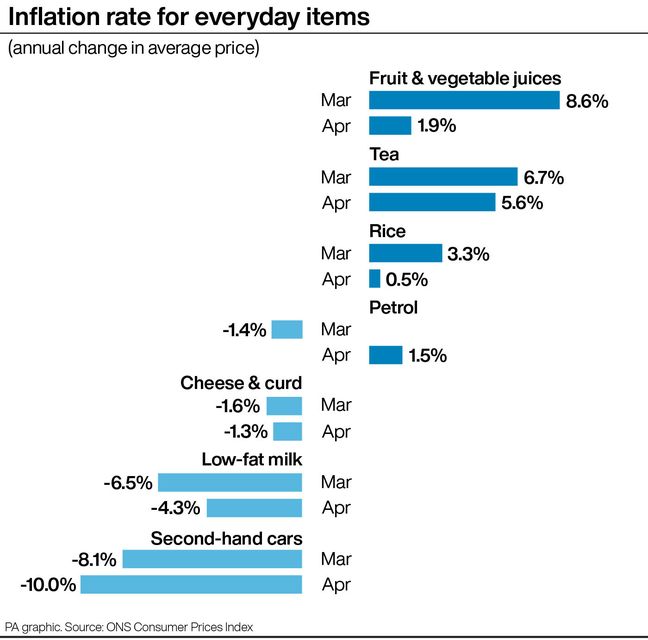

Food and drink price rises also slowed for the 13th month in a row to 2.9% in April, from 4% in March, and the lowest level since November 2021.

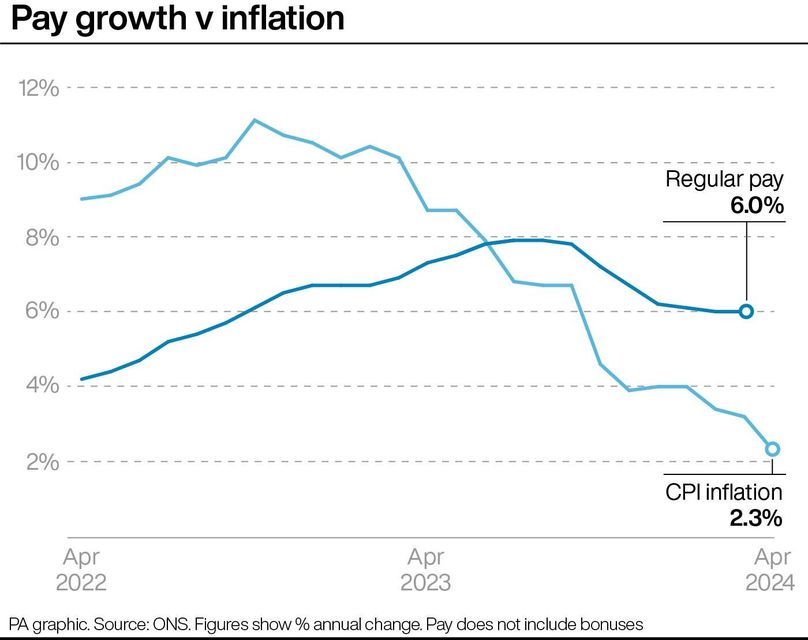

However, services inflation, which looks only at service-related categories like hospitality, culture and education, declined by significantly less than economists had predicted.

It dipped slightly from 6% in March to 5.9% in April, when analysts had forecast a rate of 5.4% for the latest month.

This was driven by stubborn price rises across restaurants and hotels, with the rate of inflation increasing to 6% in April from 5.8% in March.

Average petrol prices also rose by 3.3p per litre between March and April, the ONS said.

Shadow chancellor Rachel Reeves said: “Inflation has fallen but now is not the time for Conservative ministers to be popping champagne corks and taking a victory lap.

“After 14 years of Conservative chaos, families are worse off. Prices in the shops have soared, mortgage bills have risen and taxes are at a 70-year high.”

Experts reacting to the latest figures pointed out that the higher-than-expected services inflation figure could have an impact on when the Bank of England decides to cut interest rates.

James Smith, developed markets economist for ING, said services inflation is “the single most important indicator for the Bank of England”.

April’s figure therefore reduces the chances of interest rates being cut when the Bank’s policymakers next meet in June, he said.

Source: Belfast Telegraph